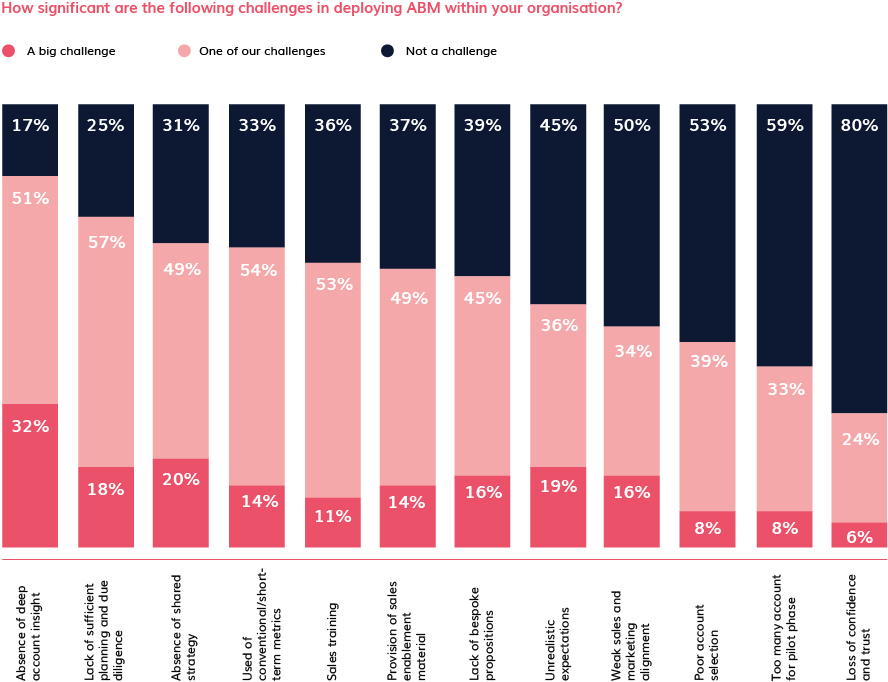

Producing audience insights is a big challenge for B2B marketers

Despite our ready access to an increasing volume and variety of data, transforming it into actionable audience insights remains challenging. Our research has shown that extracting meaningful insights from the data available presents the most significant challenge to many marketers. Because of that, the majority are working hard to fill gaps in their audience knowledge. This is supported by research from B2B Marketing that shows that 83 per cent of B2B marketers find the absence of deep account insight presents a challenge, with one-third citing it as “a big challenge”.

This is a problem that demand generation and account based marketing professionals need to address, because account insights form a vital link in the value chain that delivers the business results we are all seeking. Here’s a simple view of that value chain:

- Deeper audience insights, particularly at an account level, enable greater engagement.

- Greater levels of engagement support the development of increased personalisation, as we have more touchpoints and data to work with.

- Increased personalisation supports increased business relevance.

- Increased business relevance supports the development of a closer relationship.

- A closer relationship leads to increased revenue.

The first link in this value chain is extremely important as deeper insights facilitate greater engagement, which in turn can yield greater insights. This can be viewed either as a virtuous or vicious cycle, depending on how you look at it!

Where to start your quest for audience insights

In seeking audience insights, it is tempting to start with the technology stack and all the data it offers. However, a quick review of the Martech 5000, now actually the Martech 8000, is illustrative as to why this is not a great place to start. The current version lists 1,285 data solutions alone, broken down into nine sub-categories covering everything from audience data to web analytics. Many more of the 8K martech solutions are also sources of data!

Today, the martech technology landscape is just too big, too full of differing perspectives and offering too many overlapping capabilities to be a useful starting point. We need to come back to this when we know exactly what we need. After all, like any good buyer, we need to develop a well-researched set of requirements.

We suggest you start by determining what you need. A practical way to assess this is to review a representative customer that’s a close match to your Ideal Customer Profile (ICP). If you don’t have an ICP yet, it’s straightforward to develop one using a table to record attributes from the list below:

-

Firmographic attributes: related to the company or organisation, such as industry location, number of employees, revenue etc.

-

Technographic attributes: installed technology.

-

Behavioural attributes: based on actions and behaviour such as a specific type of product usage.

-

Psychographic attributes: reflects attitudes, aspirations, values etc. Perhaps the most well-known psychographic attribute is attitude to technology adoption – for example, ‘early adopter’ or ‘laggard’.

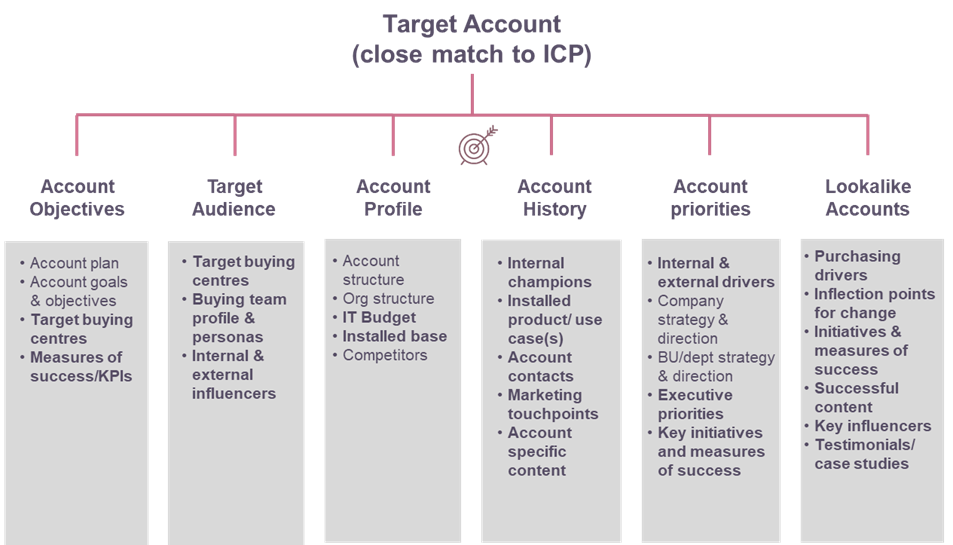

To review your selected customer, assemble a team and determine what you need from an insights perspective. That team should consist of sales, marketing and any other customer facing individuals who might be able to provide insights. The diagram below shows six ‘pillars’ that you can work through in a workshop. The last pillar, ‘lookalike accounts’, are accounts that are most similar to your ICP example. The items in bold, which includes all the items in the lookalike accounts pillar, are those that can be extrapolated across clusters of other accounts.

This approach essentially starts with a sales point of view, which is useful as it identifies the insights needed to close business – which is, after all, your ultimate objective.

With that work under your belt, you can move to a marketing point of view, starting by establishing the metrics that will best help you develop insights, bearing in mind that insights drive engagement and greater engagement drives more insights. Metrics to consider include:

-

Content consumption

-

MAP engagement

-

Number of webpage visits

-

Specific website pages visited

-

Industry topic engagement

-

Known and unknown visitor tracking

-

Visitor tracking by account

With a clear idea of the insights you wish to capture, and a set of metrics to measure progress, you can safely move to the data.

But before you start reviewing the data, it’s useful to establish a baseline. Here are some of the data types and sources to review and consider:

-

Prior Engagement Data – first-party account touchpoints (downloads, email opens, event registrations etc.) The sources are largely your MAP (such as Marketo, Eloqua etc.) and your CRM (SFDC, Dynamics etc.).

-

First-Party Data – your current first party account touchpoints (as per prior engagement, plus current website traffic). Sources include MAP, CRM, website (Adobe Analytics, Google Analytics, DemandBase etc.).

-

Third-Party Intent Data – account level, topic based and scored intent data from Bombara, Intensify, Demandbase, Triblio, 6sense etc.

-

Data Appending – this is not a data source but is vital as it involves matching leads to companies, deduplicating and company matching, including subsidiaries. Dunn and Bradstreet and LeanData are well-known sources.

-

Content Syndication – third-party publishing of content with analysis of consumption by topic, including competitors and across publishers. Ideally you will be able to both validate and normalise the publisher data.

-

Journey Tracking and Optimisation – first party product interest, product education levels and content consumption paths including product centric video. Vendors like PathFactory and Uberflip provide solutions in this area.

-

Executive Priorities – these come from qualitative research and sometimes from executive roundtables. This is often overlooked, but can provide some of the most valuable insights available.

With your audit complete, you can then determine your priorities and build a phased plan to acquire insights, incorporating more data sources over time, noting improvements over your baseline in each phase.

Making use of your insights

With the insights coming in, how do you make best use of them? We suggest there are three foundational tasks for extracting maximum value.

The first is to generate useful views of the data that can be used in account reviews. Today, there are still some challenges in delivering this in an actionable fashion, but that has to be the goal. It is important to provide a shared view for your stakeholders – if sales have one view from the CRM and marketing have another from the MAP, this will not be conducive to the tight collaboration needed to uncover deep account insights. Understanding the agenda of the account reviews will be really helpful in structuring a dashboard to support them, as insights often come out of conversations prompted by data, rather than necessarily appearing in the data itself.

The second is to develop robust and reliable account scoring, incorporating all the relevant touchpoints you are generating. Sales may well act on signals as they come in, but reliable account scoring is a great way to really test whether your data shows that an account is in market for your solutions. Account scoring will need its own roadmap as it continues to evolve in terms of both practice and technology.

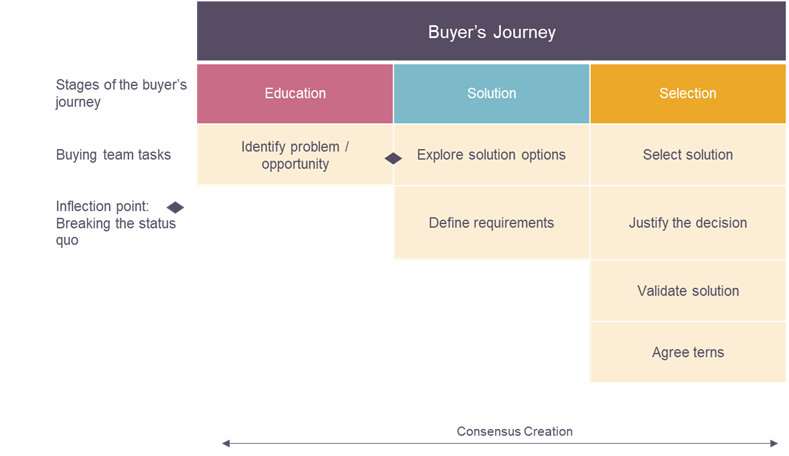

The third is to put the touchpoints you are gathering into a buying context. The buyer’s journey provides an ideal framework for this. The version you can see here is a hybrid based on the SiriusDecisions model and Gartner’s buying tasks. It incorporates the stages from Sirius and the tasks from Gartner.

We’ve included ‘agree terms’ for completeness and to support alignment between sales and marketing. The buyer’s journey is really useful from an insights perspective as it can help inform your content strategy, provides multiple opportunities to drive engagement and also forms a framework to analyse content consumption and further increase engagement. The buyer’s journey is also tremendously helpful in sales/marketing alignment as it provides a common vocabulary between your sales and marketing teams.

The ability to uncover actionable audience insights is becoming one of the most valuable skill sets in B2B marketing, particularly for ABM practitioners, who seek deep account insights. We believe taking a highly practical and phased approach makes most sense and hopefully this article will provide some inspiration for you, wherever you are on the journey.